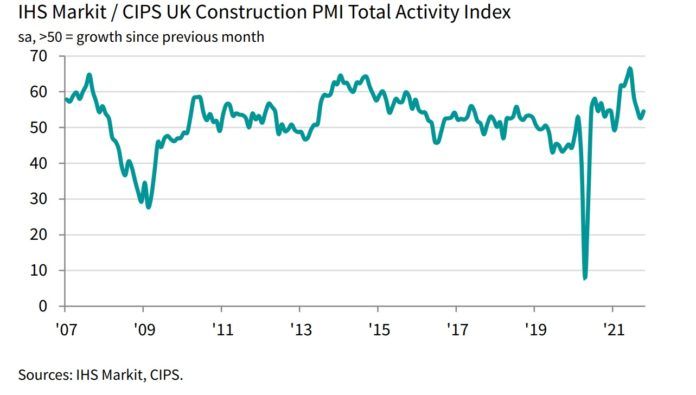

The latest CIPS UK Construction PMI data shows that business activity sped up across the UK construction sector, accelerating from September’s eight-month low, but growth remained much softer than the 24-year high seen in June.

Despite the rise in business activity however, construction companies continued to report widespread supply constraints and rapidly increasing purchase prices, although these trends were the least severe since April.

Construction activity

The headline seasonally adjusted Total Activity Index registered 54.6 in October, up from 52.6 in September. This index has now posted above the crucial 50.0 no-change value in each of the past nine months and hit a peak of 66.3 in June.

House building (55.4) performed higher than commercial work (55.0), making it the best-performing category of construction work in October, indicating the latest increase in residential work was the strongest for three months.

Elsewhere, commercial construction also expanded at a quicker pace than in September, with survey respondents citing a sustained boost from looser pandemic restrictions. Meanwhile, civil engineering activity (51.4) increased only marginally in October.

Ordering and lead times

New order growth was unchanged from September’s eight month low, and much weaker than seen on average during the summer. Construction companies mostly commented on strong customer demand, but some suggested that supply shortages and escalating costs had hindered contract negotiations.

Resilient pipelines of new work were highlighted by a steep increase in purchasing activity across the construction sector in October. The latest expansion was the fastest for three months and often reflected pre-purchasing ahead of new project starts. Employment numbers also increased at a sharp and accelerated pace in October.

More than half of the survey panel (54%) reported longer delivery times among suppliers in October, while only 2% saw an improvement. Delays were overwhelmingly linked to haulage driver shortages and international shipping congestion. However, the number of construction firms reporting longer wait times for supplier deliveries was down from 63% in September and a peak of 77% in June.

Mirroring the trend for supplier delays, the latest data also signalled another steep rise in input costs, but the rate of inflation slipped to a six-month low. Around 73% of the survey panel reported an increase in purchase prices in October, which was attributed to rising energy and commodity prices as well as raw material shortages and a lack of transport availability.

Future outlook

Finally, the near-term outlook for construction growth remained positive in October. Just over half (52%) forecast an increase in output during the year ahead, while only 8% expect a decline. The degree of optimism improved slightly since September, despite some firms citing concerns about the impact of supply shortages and sharply rising costs.

Thoughts from the FMB…

Brian Berry, chief executive of the Federation of Master Builders (FMB), said: “It’s good to see that the construction industry has picked up steam following a slight low after the summer rush for building work following pandemic restrictions being lifted across the UK. What is concerning is the continued skills and material shortages hindering growth in the industry. The UK Construction PMI data results show customer demand for building work is there, but contracts are not being signed because supply shortages and spiralling costs are stalling negotiations.

“From the FMB’s latest State of Trade Survey Q3, we know that 89% of small, local builders have had to press pause on jobs and 97% have experienced increased material costs. The government needs to make good on its budget promise to boost skills training to get more apprentices into the construction industry and ensure supply chains remain resilient so that goods can move easily from ports to sites”