Construction and infrastructure workloads bounced back at the start of 2021, as the UK set about building back better, according to the RICS UK Construction and Infrastructure Monitor for Q1 2021.

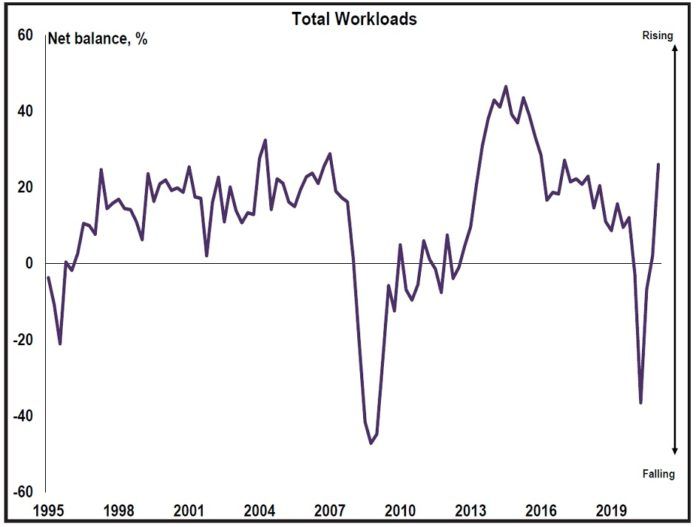

Respondents to the latest RICS survey reported the highest reading (net balance) for workloads since the early 2016, with +26% more respondents reporting a rise in workloads at the all-sector level; (+2% Q4 2020).

The private residential sector drove the growth, with +39% more respondents reporting a rise in workloads over the first three months of 2021. Infrastructure workloads picked up further with +34% of respondents reporting a rise. Social housing and public works also increased over the quarter, as did private industrial and commercial, but to a lesser extent.

What’s more, as the UK COVID-19 restrictions gradually lift, respondents reported an increase in new business enquiries, and for the third consecutive report, a rise in new hires.

Looking ahead, +44% of respondents also expect workloads to rise for the coming 12 months, and more firms are expected to increase employment (+37% up from +17% in Q4 2020). The greater level of confidence is also reflected in profit margins, which returned to positive territory for the first time in over two years (Q4 2019).

When looking at the challenges that could impact how quickly the UK can build back better, 57% of respondents reported a shortage of materials being their main impediment. Financial constraints and a shortage of labour also continue to be issues that are holding back projects. However, financial constraints have lessened since this time last year, when 70% of respondents reported it as their biggest challenge, compared to 45% in this report.

To assess the impact of COVID on the global construction sector, additional questions were included in the Q1 2021 report. The first question looked at the issue of project cancellation because of the pandemic.

Interestingly, the UK faired better than the rest of Europe and above the global average. For housing and infrastructure sectors, the results imply that between 3% and 4% of projects have been permanently cancelled, rising to 6% when looking at non-residential.

Simon Rubinsohn, chief economist at RICS, said: “The rebound in workloads over the past quarter, allied to the positive expectations for the next 12 months, paints a positive picture regarding a broader recovery in the economy. But what is particularly encouraging is the suggestion that not just the construction and infrastructure sector will start hiring once again, but also that the compression in profit margins may just be beginning to turn around.

“While it will take more than one quarter to signal the emergence of a sustainable trend in profitability, the indications are that the industry has adjusted relatively well to COVID related work practices with most respondents to the survey suggesting only a small hit to productivity. Alongside this, the fact that over 80% of respondents are not seeing evidence of tenders coming in below bids is another positive signal regarding how the sector has weathered this storm.”