The latest Construction Industry Forecasts predict further growth for the construction industry despite Q3 figures reflecting a downward revision since the summer, largely owing to a slowdown in third quarter housing and commercial activity.

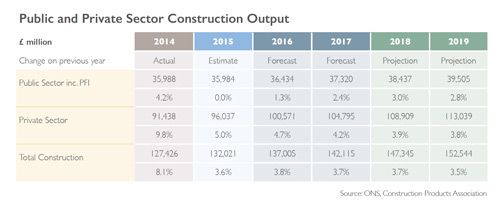

The report, published by the Construction Products Association, predicts that construction output is expected to increase by 3.6% in 2015 and 3.8% in 2016. These figures have been revised down from the Summer Forecast that predicted 4.9% and 4.2% respectively.

The energy sector specifically is predicted to see a significant rise in construction output with a 118.1% increase by 2019, contrasted with the public housing sector starts which can expect to see a fall of 10% in 2015, a further 5% in 2016 and no growth projected through to 2019, totaling a 14.5% decrease on the 2014 figures.

This drop in Q3 activity is not expected to be permanent, as Dr Noble Francis, economics director stated: “We remain positive about prospects for the construction industry. The slowdown in Q3 activity is expected to be temporary and construction output is expected to rise by 19.7% between 2015 and 2019, driven by growth in the three largest construction sectors; private housing, commercial and infrastructure.”

The report forecasts private housing starts to rise 7.0% in 2015 and 5.0% in 2016; offices construction to increase 8.0% in 2015 and 7.0% in 2016; and infrastructure output is forecast to rise 13.2% in 2015 and 7.6% in 2016.

Dr Francis continued: “Private housing starts are forecast to rise, with major house-builders signalling their intention to build more homes over the next 12-18 months. House prices continue to increase in most regions, especially in London and the South East, illustrating a strong underlying demand.

“Public housing, however, is expected to be adversely affected by uncertainty and a lack of funding due to the extension of Right to Buy to housing associations and cuts to social rent.

“The commercial sector is forecast to enjoy growth from 2016 averaging 3.9% per year through to 2019. New offices construction is expected to be the primary driver of this growth, with increasing activity in cities such as Birmingham and Manchester as well as growth in the capital.

“Whilst growth prospects in construction remain positive, there are significant risks. Government austerity focuses on current spending rather than capital investment but the risk remains that if Government cannot reduce current spending as much as it anticipates, it may cut public construction projects to achieve its aims of eliminating the public sector deficit. In addition, within the construction industry, the key concerns regard skills shortages, which have already been reported in the housing sector but may become more prevalent across the wider industry over the next 12-18 months due to the forecast growth.”