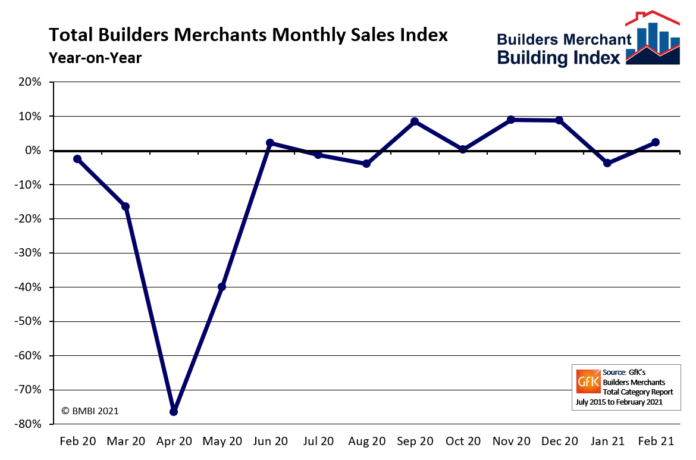

Value sales by Britain’s builders’ merchants increased by a further 2.3% in February compared with February 2020, according to the latest Builders Merchants Building Index (BMBI) report.

Despite the total increase, only three categories reported sales growth. The increase was largely driven by the timber and joinery products category, which surged by 18.2% in February. Landscaping sales remained strong and were up 8.6% compared with February 2020, while sales of tools (+2.0%) also increased.

Sales in the largest category, heavy building materials, were down 1.8% year-on-year, and indoor trades remained affected by the latest lockdown and showroom closures. Kitchens and bathrooms (-8.6%), decorating (-8.4%) and plumbing, heating and electrical (-3.6%) all had lower sales compared to February last year.

However, there were positive signs for indoor trades, as sales of kitchens and bathrooms, decorating and tools were up significantly compared with January 2021. Compared with the previous month, the total February 2021 sales were 8.6% higher, with landscaping recording the highest monthly growth rate at 24.1%.

Commenting on the results, Mike Rigby, chief executive officer of MRA Research, said: “February’s BMBI index demonstrates the strength of the domestic repair, maintenance and improvement (RMI) sector. The latest Office for National Statistics figures also show that private housing RMI outperformed every other construction sector in February with 6.7% growth year-on-year and is one of very few sectors to have recovered above its pre-pandemic level.

“Overall, builders merchants’ sales performance continues to impress, and the overall picture is very positive, but the pace of recovery has varied between product sectors, leading to increasing polarisation. The timber and joinery category, for example, has performed particularly strongly in the first two months of 2021.

“Demand for timber and joinery products has been exceptional and there are reports of record-low stocks at some sawmills that closed down earlier in the year, which could lead to further price increases and even potential supply shortages in the sector. Sustainability is a key driver of demand too, and as householders continue to work from home and invest in garden buildings and other projects, demand will likely stay high for some time.”

Mike continued: “On the other hand, the kitchens and bathrooms and plumbing, heating and electrical categories were more than 20% below last year’s level on a rolling 12-month basis, as showrooms remained closed in February and householders were reluctant to undertake bigger projects, such as replacing bathrooms, kitchens or boilers, while being stuck at home.

“However, month-on-month growth in a number of ‘indoor’ categories was encouraging. The latent demand will have a positive impact on plumbing, heating and electrical and kitchens and bathrooms sales as restrictions gradually ease, and differences should start to even out.”

February’s BMBI report is available to download at www.bmbi.co.uk.