The construction industry experienced a mixed quarter for sales, output and new orders in the final three months of 2018, according to a quarterly survey of the supply chain’s product manufacturers, contractors, civil engineers and SME builders by the Construction Products Association.

The Construction Products Association’s Construction Trade Survey for 2018 Q4 shows that during the quarter, sales of construction products rose according to 55% of heavy side manufacturers and 21% of light side manufacturers, whilst 25% of SME builders reported an increase in workloads. However, output, new orders and enquiries were reported lower by main building contractors, specialist contractors and civil engineering contractors. Rising costs for raw materials continued to filter through the supply chain, as reported by two-thirds of main contractors, 82% of heavy side product manufacturers and 74% of light side manufacturers and combined with lower volumes of work, continued to squeeze profit margins for building contractors.

Commenting on the survey, Rebecca Larkin, senior economist at the CPA, said: “Parts of the construction supply chain have clearly started to feel the effects of the falls in new orders since the EU referendum translating into reduced activity in sectors such as high-end residential, commercial offices and industrial factories. The uncertainty that precludes investment decisions in these sectors with a high upfront outlay may also be benefiting other areas of the supply chain. Product manufacturers’ optimism looking towards 2019 may be reflective of continued high levels of activity in buoyant regions outside of the South East, as well as an element of precautionary stockpiling on-site providing a near-term sales uplift.”

Brian Berry, chief executive of the Federation of Master Builders, said: “Workloads for small construction firms continued to rise in the last quarter of 2018 but after 23 consecutive quarters of growth, these latest results could mark a tipping point. Mounting Brexit uncertainty is starting to have a tangible effect and the indicators are not good with almost half of builders reporting signs of a weakening housing market. Furthermore, a worrying one in five construction SMEs has had projects stalled in the past three months due to delays to loans, or loan refusals, from the banks. Together with ever-rising costs due to material price hikes and labour shortages, the headwinds are blowing in the wrong direction for the UK construction sector.”

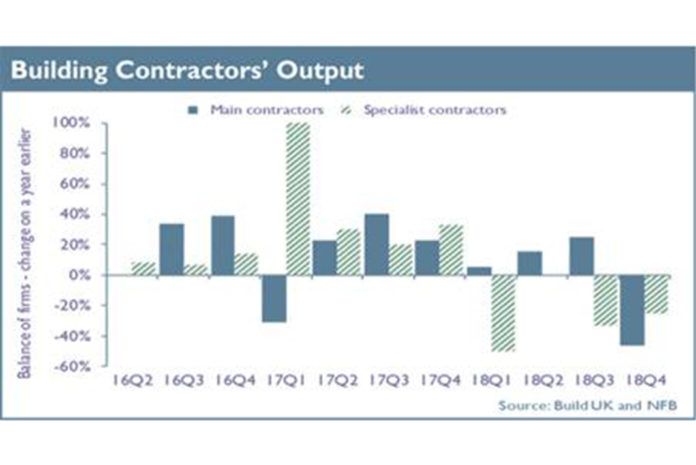

Commenting, Build UK policy manager, David Bishop, said: “The latest State of Trade result highlights a difficult Q4 with half of main contractors and a quarter of specialists reporting a decrease in output compared to this time last year. Furthermore, the lack of required skills remains a concern along with the ongoing uncertainty caused by Brexit. Build UK has worked with other industry bodies, including all those involved in proceeding the State of Trade, to collate a report which identifies occupations that are experiencing, or may experience, shortages of available staff in the UK construction sector. This has been shared with industry and government.”

Key survey findings include:

- On balance, 46% of main building contractors and 25% of specialist contractors reported that construction output fell in the fourth quarter of 2018 compared with a year ago

- 3% of civil engineers, on balance, reported a decrease in workloads during Q4

- On balance, 25% of SME contractors reported increased workloads in Q4 compared to three months earlier

- Main contractors reported that order books were only higher in the housing R&M sector

- 8% of civil engineering firms reported a decrease in new orders in Q4, on balance

- 14% of SMEs reported an increase in enquiries in Q4, on balance; enquiries fell for 25% of specialist contractors

- Overall costs increased for 86% of civil engineering contractors, whilst two-thirds of main contractors, 82% of heavy side product manufacturers and 74% of light side manufacturers reported a rise in raw materials costs

- Profit margins fell for 13% of main contractors and 40% of specialist contractors in Q4.