August data pointed to a renewed slowdown in output growth across the UK construction sector, with all three broad categories of activity recording a loss of momentum since the previous month. That said, there were signs of resilience in terms of underlying workloads, with the latest survey signalling another solid upturn in new business. Employment growth meanwhile held close to the two-and-and-a-half year peak seen in July. Rising demand for construction inputs meant that stretched supply chain capacity continued during August, as highlighted by the greatest lengthening of vendor lead-times since March 2015.

August data pointed to a renewed slowdown in output growth across the UK construction sector, with all three broad categories of activity recording a loss of momentum since the previous month. That said, there were signs of resilience in terms of underlying workloads, with the latest survey signalling another solid upturn in new business. Employment growth meanwhile held close to the two-and-and-a-half year peak seen in July. Rising demand for construction inputs meant that stretched supply chain capacity continued during August, as highlighted by the greatest lengthening of vendor lead-times since March 2015.

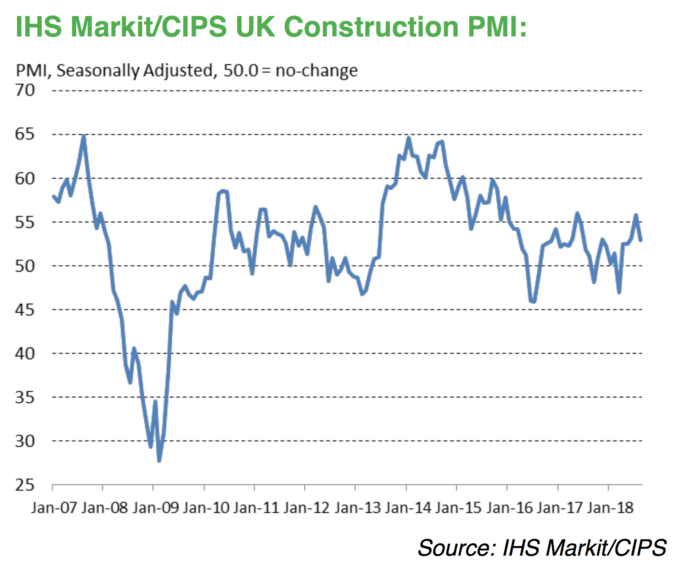

At 52.9 in August, the seasonally adjusted IHS Markit/CIPS UK Construction Purchasing Managers’ Index (PMI) eased from July’s 14- month peak of 55.8 but remained above the crucial 50.0 no-change mark. The latest reading signalled a moderate overall rise in construction output, with the rate of expansion the weakest since May.

Commercial building was the best performing area of construction output in August, followed closely by residential work. However, the latest expansion of housing activity was the weakest since March. Meanwhile, work on civil engineering projects decreased for the first time in five months. A number of survey respondents cited a lack of new work on infrastructure projects.

Mirroring the trend for construction output, latest data revealed a slowdown in new business growth from July’s 14-month peak. Anecdotal evidence cited resilient client demand and supportive economic conditions, but there were also reports that Brexit-related uncertainty continued to hold back investment spending. Higher overall workloads encouraged additional staff recruitment across the construction sector in August. Survey respondents noted tight labour market conditions and shortages of suitably skilled candidates to fill vacancies.

Purchasing activity increased for the eleventh consecutive month in August, although the latest upturn was the weakest since March. Low stock and labour shortages among suppliers continued to impact on delivery times for construction products and materials. The latest deterioration in supplier performance was the greatest seen for almost three-and-a-half years. Despite stretched supply chains and rising energy-related costs, latest data indicated that input price inflation edged down to its lowest since July 2016.

UK construction companies are optimistic that business activity will expand over the coming 12 months, but the degree of confidence eased to its weakest since May. Survey respondents cited confidence about achieving organic growth through new project wins and geographical diversification, while Brexit uncertainty remained the main factor cited as holding back sentiment.

Comments

Tim Moore, associate director at IHS Markit and author of the IHS Markit/CIPS Construction PMI, said: “The construction sector slipped back into a slower growth phase in August, with this summer’s catch-up effect starting to unwind after projects were delayed by adverse weather at the start of 2018.

“Civil engineering was the worst performing area of the construction sector, with output in this category falling for the first time since March amid reports citing a lack of new work on infrastructure projects. Housebuilding saw a particularly sharp slowdown since July, meaning that commercial construction was the fastest growing sub-sector in August.

“There are some encouraging takeaways from the latest survey, especially the resilient degree of new business growth in August and a strong upturn in staff recruitment. Survey respondents noted that they are confident about achieving organic growth at their businesses in the coming 12 months. The degree of optimism reported in August remained constrained by external factors, including domestic political uncertainty, stretched supply chains and shortages of suitably skilled labour.”

Duncan Brock, group director at the Chartered Institute of Procurement & Supply, said: “Cracks in the construction sector’s masonry were beginning to show again this month, and the housebuilding sub-sector was hit the hardest as it reported the poorest performance since March this year.

“Civil engineering saw a drop off in larger infrastructure projects and found itself in contraction territory. Levels of new work held moderately steady overall, but with any significant growth held back by Brexit uncertainty. It was also the logjams in supply routes that hampered work in hand where material and skills shortages meant vendor performance deteriorated to its worst level since March 2015.

“If there is anything positive to note from this month, it would be that the rate of hiring remained strong. However, persistent pressures from skills shortages and slow rates of new orders will continue to hit business optimism still trailing below the survey’s average.

“The sector is hovering too close for comfort to the no change mark which makes it a contender for more disappointment next month. Though the path to Brexit is paved with good intentions, without significant progress the sector will soon be building castles in the air rather than on solid ground.”