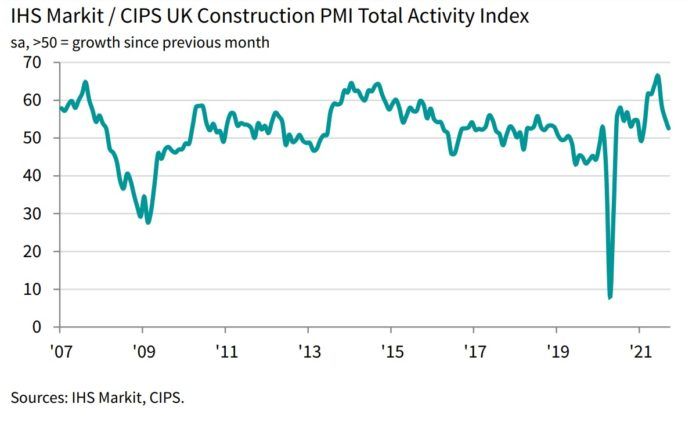

The latest figures from the IHS Market/CIPS have revealed that there was another growth slowdown in the construction sector in September, with output volumes rising to the smallest extent for eight months, partly reflecting softer demand conditions than the peak seen earlier in the summer.

At 52.6 in September, down from 55.2 in August, the headline seasonally adjusted IHS Markit/CIPS UK Construction PMI Total Activity Index dropped further below the 24-year high seen in June (66.3). The latest reading signalled only a moderate expansion of total construction output and the weakest speed of recovery for eight months. Reports from survey respondents linked the slowdown to a combination of supply chain issues and softer demand, with some citing a lack of transport to site, as well as staff shortages.

Furthermore, a rapid drop in sub-contractor availability was reported in September, with imbalanced demand and supply contributing to the steepest rise in sub-contractor charges since the survey began in April 1997.

Some firms noted that this, along with other issues with unpredictable pricing, had slowed clients’ decision-making on new orders and led to delays with contract awards.

Construction activity

Meanwhile, all three broad categories of construction activity saw a loss of momentum in September, with the biggest slowdown seen in civil engineering (51.0, down from 54.8 in August).

House building also decelerated in September, with the latest expansion the weakest since the recovery began in June 2020 (52.8). This left the commercial segment (53.6) as the best performing category during September, reflecting a continued boost to order books from the reopening of the UK economy.

New work

Construction companies recorded a moderate increase in new work during September, with the rate of growth easing sharply to its weakest since the start of 2021. The slowdown was linked to hesitancy among clients and less favourable demand conditions.

September data also indicated another strong rise in employment numbers across the construction sector, driven by greater workloads and stretched business capacity. However, the latest rise in staffing levels was the least marked since April, which partly reflected long wait times to fill vacancies.

Price increases

Purchase prices increased rapidly in September, although the rate of inflation eased further from June’s all-time peak. Around 78% of the survey panel reported a rise in their cost burdens – mostly linked to supply shortages and transport surcharges.

However, despite the slowdown and supply issues, construction firms remain highly upbeat about the business outlook, with just over half (51%) forecast rising output, while only 8% anticipate a decline. Nevertheless, the degree of confidence was weaker than August amid some concerns that the supply chain crisis will hinder growth.

Industry reaction

Ian Cooper, director at global legal business DWF, said: “The September data shows another slowdown in growth in the construction sector, with output volumes rising to the smallest extent for eight months. Understandably, some construction businesses may be holding off on construction decisions until the market conditions show some signs of stability.

“On the flipside, the confidence of construction firms remains high, and this is good news for job seekers as the demand for skilled labour is relentless.

“Aligned with the current experience of other industry sectors, skilled labour supply chain issues remain a challenge for construction. However, this also reveals opportunities for increased productivity initiatives such as pre-fabricated / off site construction.”