Following the recent release of the UK Construction PMI, Joe Sullivan, partner at MHA, says despite the housing market’s buoyancy continuing, labour shortages and material supply issues are threatening to curtail recent sector growth.

“Output growth in the construction sector was slightly dampened again in August, as a consequence of tightening supplies and the traditional holiday season, rather than flagging demand,” said Joe.

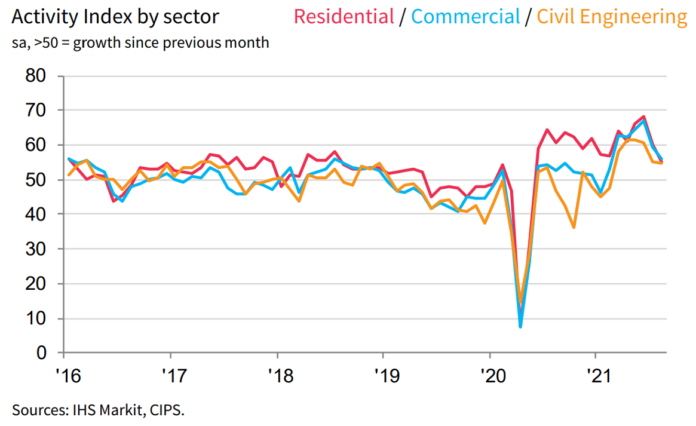

The headline seasonally adjusted IHS Markit/CIPS UK Construction PMI Total Activity Index posted 55.2 in August, down from 58.7 in July, indicating that activity has expanded in each of the last seven months. However, the rate of increase eased to the softest since February as supply of materials and transport began to impact the sector and subsequently construction output.

UK construction companies have signalled a further increase in output volumes during August, however the pace of growth eased notably from the previous survey period. There were softer expansions across housebuilding, commercial work and civil engineering activity, as well as in new order growth despite a further increase in output volumes during August.

Moreover, the companies also noted supply chain disruption in the month, which caused a rise in input prices, and one that was the second sharpest in the history of the survey.

Index assessment

Commercial work (index at 56.0) was the best performing broad category of construction output in August, followed closely by housebuilding (55.0), while civil engineering remained the slowest growing subsector (54.8) for the fourth month in a row.

Meanwhile, total new work increased for the 15th consecutive month in August. While the latest improvement in order books was marked overall, the rate of growth softened to the weakest since March.

Businesses noted a continued resumption of projects that had been delayed due to Brexit and the pandemic, though client confidence was dampened by volatility in raw material supplies and increased cost burdens.

Job creation

Amid softer growth in new orders, the rate of job creation eased to a four-month low in the latest survey period. Firms continued to note that strong market conditions had sustained demand for new employees, though additional cost burdens and a lack of skilled workers began to weigh on the rate of hiring.

Input buying

Input buying expanded at the slowest pace since January. Strong rises in demand for construction materials continued to stretch supply chains however, as some firms noted difficulty in sourcing and receiving purchased inputs.

This occurred as supplier delivery times continued to lengthen at a substantial rate, though one that was slightly improved from June’s record deterioration. Anecdotal evidence suggested that ongoing material shortages were exacerbated by a lack of transport and freight availability, compounding existing issues related to the supply of materials due to port congestions and demand and supply imbalances.

As a result, input cost inflation accelerated to the second fastest rate in the 24-year history of the survey, surpassed only by the record rise two months prior. Among those materials reported as up in price, the most common were concrete, fuel, steel and timber.

Commenting on the PMI report, Joe said: “The remarkable price rises in the UK’s housing market continued, powered by the favourable macro conditions of low interest rates, mortgage availability and consumers’ confidence in job security. The reduced stamp duty holiday has proved to be no obstacle to further house price growth, suggesting these background conditions allied to a sustained desire to move out of conurbations will maintain demand.

“However, constrained labour and material supply issues are starting to have a greater negative impact in the sector. Quite simply, it is taking longer to complete contracts and becoming more expensive to do so. The industry is not alone in being affected by well-reported driver shortages, which are compounding the material shortage. We expect supplies will become even more strained as the lag associated with annual European factory shutdowns, for holiday and maintenance, impacts the sector as we move into the autumn.”

Joe continued: “Contractors need to understand their contractual obligations, and proactively manage orders and the expectations of all stakeholders throughout their activity chain, something which may prove increasingly difficult in future months.

“Further ahead, increased inflation will erode budgets and potentially weaken demand. It feels like conditions are set fair for greater turbulence before the year turns. Only time will tell if the Bank of England will soften in its attitude towards an increase in the base rate, adding further potential uncertainty. However, for now, significant demand on both commercial and residential fronts remains as a key solace.”

Agreeing with Joe, Brian Berry, chief executive of the Federation of Master Builders (FMB), said: “Builders throughout the UK, particularly smaller firms, are struggling to recover from the pandemic because of the continued materials crisis.

“For some time now, demand for building materials has been outstripping supply, with this month’s data representing the second-fastest rate for input cost inflation since recording began. The FMB’s latest membership survey revealed the prevalence of this crisis within the sector, with 98% of members experiencing price increases for building materials. It’s vital that transparent allocation and pricing policies are implemented to help enable SMEs to have continued and stable access to materials. The government should also re-evaluate their position regarding issuing temporary visas for EU HGV drivers, to better enable the delivery of materials.”

Brian continued: “Notwithstanding the wider economic impact risked by consumers choosing not to undertake building projects because of delays, there is also a real risk that the current environment is exploitable by cowboy builders.

“Builders are working hard to stick to agreed timelines, but consumers must be cautious about promises to complete jobs quickly and cheaply. All too often these will be too good to be true and could well leave households at the mercy of unscrupulous cowboy builders.”