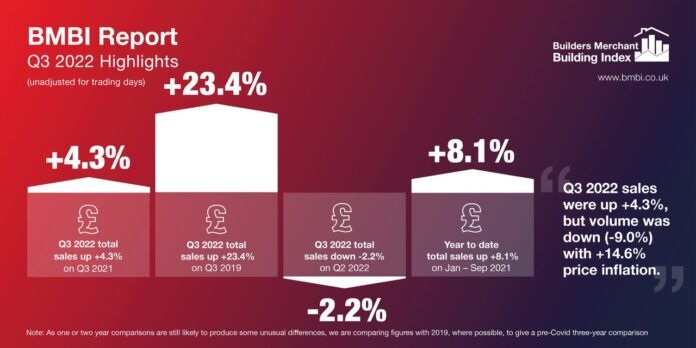

The Builders Merchants Federation’s (BMF) latest Builder Merchants Building Index (BMBI) report reflects the undercurrent of economic uncertainty evident throughout the third quarter of the year, with almost all market growth coming from pricing.

Q3 2022 vs Q3 2021

While total sales in Q3 2022 were up by +4.3% on Q3 2021, sales volumes fell by

-9.0%, and prices increased by +14.6%. With one less trading day during Q3 2022, like-for-like sales values increased by +5.9%.

Timber & Joinery and Landscaping were the only categories to sell less this quarter, with sales values down by -11.1% and -1.3% respectively.

The other major trend was the price growth of the largest category, Heavy Building Materials, up by +21.2%, with Aggregates, Cement and Plasterboard some of the main contributors.

Kitchens & Bathrooms (+17.2%), and Plumbing, Heating & Electrical (+14.2%) were among the categories which grew faster than Merchant sales overall. These were led by the smaller categories of Renewables & Water Saving (+38.4%) and Workwear & Safetywear (+23.6%)

Q3 2022 vs Q2 2022

Total sales in Q3 were -2.2% lower than in the previous three months. Sales volumes fell by -5.5% and prices increased by +3.5%. However, with four more trading days during the latest quarter, overall like-for-like sales were -8.3% lower than in Q2 2022.

Renewables & Water Saving (+14.5%), Workwear & Safetywear (+8.1%) and Kitchens & Bathrooms (+6.2%) fared best, with the seasonal Landscaping category the weakest performer at -18.3%.

Year to date 2022 vs 2021

Year to date indicators for 2022 show both Timber & Joinery (+0.6%) and Landscaping (+0.5%) remaining almost flat in value, with volume declines of -17.8% and -13.5% respectively, counteracting price growth. Sales volumes were down by -4.0% for Heavy Building Materials, with value up by +12.6%. All three categories have seen year-on-year price growth of between 16-22%.

The overall Lightside category, including Decorating, Tools, and Kitchens & Bathrooms, saw a small volume decrease of -1.6%, but increased by +12.5% in value due to a +14.3% growth in price.

John Newcomb, CEO of the BMF, said: “We have seen a pattern emerge throughout the year with sales value increases largely driven by price inflation rather than volume growth. Following the Autumn Statement, commercial and retail customers alike will increasingly feel the combined squeeze of rising prices, interest rates and taxes. This will undoubtedly feed into the next 12 months as the Chancellor’s measures to counteract recession further reduces consumer spending power.”

Emile van der Ryst, senior client insight manager at Trade at GfK, added: “This consistent theme of price increases and volume declines mirrors much of what is seen across the UK economy and like other sectors there’s probably an expectation that volumes will continue decreasing. In September, GfK’s Consumer Confidence set a record low since tracking started in 1974, a clear reflection of the difficulties currently experienced. The final quarter of the year will be increasingly difficult, as highlighted by the Bank of England expecting a two-year recession.”