January data pointed to a loss of momentum for the UK construction sector, with business activity growth easing to its weakest for ten months. New orders increased only marginally at the start of 2019, which contributed to the slowest expansion of employment numbers for two-and- a-half years. A number of survey respondents noted that Brexit uncertainty had led to hesitancy among clients and a corresponding slowdown in progress on new projects.

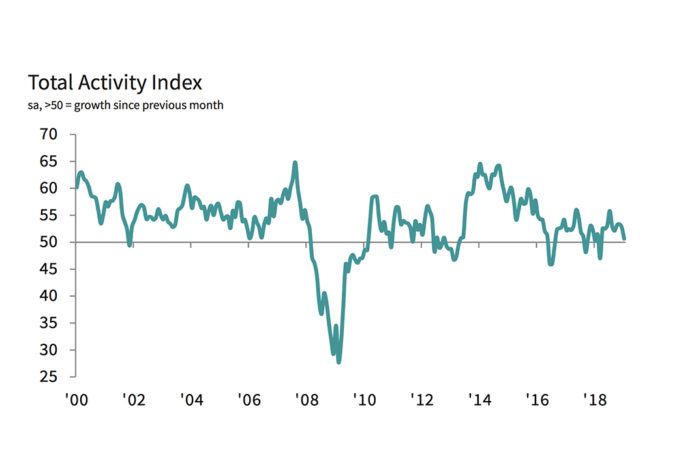

The headline seasonally adjusted IHS Markit/CIPS UK Construction Total Activity Index dropped to 50.6 in January, from 52.8 in December. The index has posted above the 50.0 no-change mark in each month since the snow- related decline seen in March 2018, but the latest expansion was the weakest seen over this ten-month period of growth.

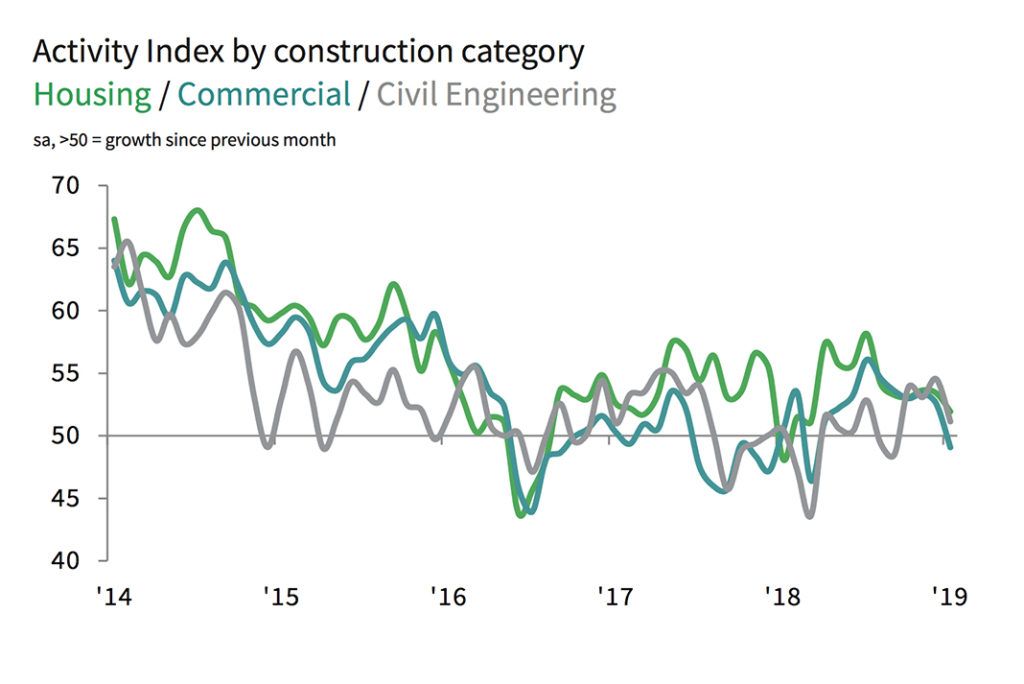

All three categories of construction output recorded weaker trends than those reported in December. Residential work was the strongest performing area, although the latest expansion was only modest and the slowest seen since March 2018. Civil engineering activity increased marginally, with the rate of growth much softer than December’s 19-month high.

Commercial work was the weakest performing area of construction output in January. Latest data indicated a decline in work on commercial construction projects for the first time in ten months. Anecdotal evidence suggested that Brexit-related anxiety and associated concerns about the domestic economic outlook continued to weigh on client demand.

New business growth eased to an eight-month low in January. Construction firms widely commented on softer demand conditions and longer sales conversion times, reflecting a wait-and-see approach to spending by clients. Concerns about the near-term outlook for new projects resulted in more cautious staff-hiring policies at the start of 2019. The latest survey pointed to the slowest rise in employment numbers since July 2016.

Meanwhile, slower growth of input buying helped to reduce pressure on construction supply chains in January. The latest deterioration in vendor performance was the joint-weakest since September 2016. Construction firms also pointed to the smallest reduction in sub-contractor availability for two-and- a-half years.

Input price inflation continued to moderate in January, with average cost burdens rising at the slowest pace since June 2016. Where an increase in purchasing costs was reported, this was generally linked to rising prices for imported construction products and materials.

Construction firms remain positive about the outlook for business activity in 2019. Around 41% of the survey panel anticipate a rise in output, while only 16% forecast a fall. However, the resulting index signalled a moderation in optimism since December. Large-scale civil engineering projects were cited as a key source of optimism, while and Brexit uncertainty was the most commonly cited concern.

Tim Moore, Economics Associate Director at IHS Markit, which compiles the survey:

“UK construction growth shifted down a gear at the start of 2019, with weaker conditions signalled across all three main categories of activity. Commercial work declined for the first time in ten months as concerns about the domestic economic outlook continued to hold back activity. The latest survey also revealed a loss of momentum for house building and civil engineering, although these areas of the construction sector at least remained on a modest growth path.

“Staff recruitment slowed to a crawl in January, with construction firms reporting the softest rate of job creation since July 2016. Delays to client decision- making on new projects in response to Brexit uncertainty was cited as a key source of anxiety at the start of 2019. Difficulties converting opportunities to sales were reflected in a slowdown in total new business growth to its lowest since last May.

“Business expectations for the year ahead slipped to a three-month low and remained subdued in comparison to historic trends in January. Positive sentiment towards the outlook for civil engineering work remains a key factor helping to support business sentiment across the construction sector, according to survey respondents.”

Duncan Brock, Group Director at the Chartered Institute of Procurement & Supply:

“The sector suffered a sharp drop in output growth in January, and the softest rise in purchasing volumes since September 2017, as Brexit continues to hamper progress and dampen client confidence.

“Residential building, the stalwart of the sector leading the way in the last six months, lost its momentum with the weakest performance since March 2018. However, commercial building suffered the most of the three sub- sectors declining for the first time in just under a year. Larger orders were held back by clients and overall activity slowed.

“The biggest shock came in the form of job creation which has managed to suffer the slings and arrows of Brexit highs and lows with solid hiring since the referendum result. Employment rose at the slowest rate since July 2016 and with optimism also in short supply, the sector only needs a small nudge to tip it closer to recession.”