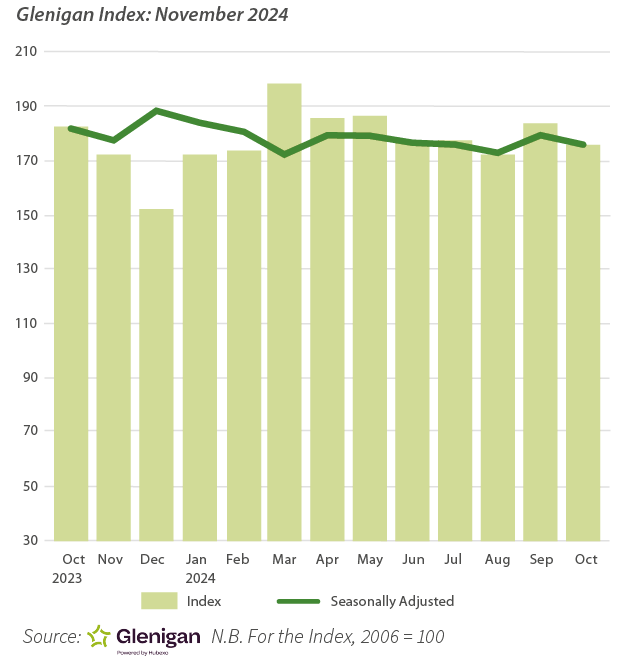

Glenigan’s November 2024 Construction Index has reported that construction activity has begun to stabilise with project-start levels holding steady in the three months to the end of October.

The Index, which focuses on the three months to the end of October 2024, covering all underlying projects with a total value of £100m or less, reported that both residential and non-residential sectors managed modest gains, inching up on the preceding period.

However, civils starts dragged, despite strong performance earlier in the year, dropping 8% against the preceding quarter.

Sector Analysis – Residential

The overall value of residential project-starts improved during the Index period, rising 1% against the preceding quarter. However, the value remained 8% lower than the previous year.

Private housing was the November Index’s stand-out performer, with work starting on-site increasing 1% compared to the preceding three months and the same on 2023 levels.

Social housing starts stabilised, with starts unchanged on the preceding three-month period. However, it performed poorly compared to the previous year, slipping back 32%.

Sector Analysis – Non-Residential

Performance in non-residential sectors was mixed, with some verticals rallying during the Index period.

Hotel & Leisure starts experienced a strong period, growing 50% against the preceding three months and almost doubling (+93%) compared to the same time a year ago. Performance in the sector was boosted by work starting on-site at a new hotel on the MIX Science Park in Manchester.

Work starting on-site in the industrial sector stabilised, with starts remaining flat on the previous three months. However, industrial starts were up 21% on a weak performance a year ago.

Health starts also experienced a healthy period, increasing 8% against the preceding three months, yet remaining 8% below 2023 levels.

Civil engineering starts experienced a mixed period, dropping 8% against the preceding three months but remaining 1% above 2023 levels. Infrastructure starts drove growth during the period, increasing 9% compared to the previous year despite standing 9% down on the preceding three months. However, utilities starts declined 6% against the preceding three months to stand 10% down on the year before.

Office starts experienced a very poor period with the value of project-starts registering the greatest decline compared to last year (-30%), also dropping by 12% during the three months to the end of October.

It was a similar story for retail, with the value of underlying project-starts falling 13% against the preceding three months and 17% on the previous year.

Education (-6%) and Community & Amenity (-9%) starts also posted declines during the three months to October and stand 14% and 10% lower respectively than a year ago.

Regional Analysis

The West Midlands was a bright spot during the Index period, with starts shooting up 28% during the three months to October but remaining 17% down on a year ago.

The East of England (+21%), South East (+16%), and South West (+10%) saw double-digit growth from August to October. All three regions experienced growth against last year, with starts increasing 27%, 42% and 18%, respectively.

Scotland also saw an increase, rising 6% on the preceding three months but remaining 14% down on the previous year.

In contrast, the East Midlands fell back 15% against the preceding three months to stand 14% down against the previous year. After a period of strong growth, Northern Ireland fell by 40% against the preceding three months but remained 8% up against the previous year.

Project-starts in London remained level on the preceding three months but were 18% down on the year before.

Yorkshire & Humber and Wales suffered falls in project-starts against both the preceding three months and the previous year.

Commenting on the findings, Allan Wilen, economic director at Glenigan’s, said: “Promisingly, the recent deterioration in project starts has eased off over the past few months. This will come as a huge relief across the entire construction supply chain. Modest growth in both the residential and non-residential sectors, whilst not spectacular, is encouraging in an otherwise challenging environment and verifies our prediction of gradual recovery next year, and in 2026.

“Of course, last week’s Budget will provide a further potential boost. The Chancellor’s changes to the fiscal rules will release funds for investing in schools, health, infrastructure, industrial and social housing, providing extra work for the industry. Further, it will allow projects like the HS2 Old Oak Common to Euston extension and the TransPennine upgrade, which have been hanging in the balance over the last four months, to get off the ground in the next fiscal year. With more critical investment set to buoy the industry, it will be interesting to see how these policy and spending commitments play out in the coming months, and how they affect our December, January and February indexes.”