Construction activity in the UK slowed in July as residential construction faltered and sub-contractor availability dropped for the 25th month running, according to the latest survey from Markit and the Chartered Institute of Purchasing & Supply (CIPS).

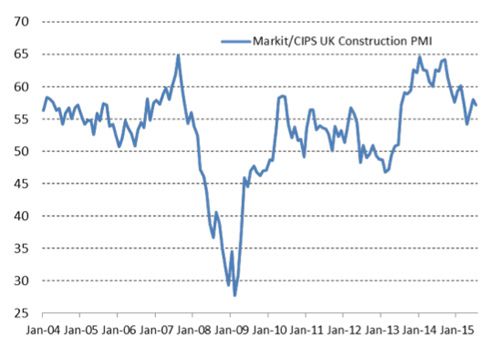

The Construction PMI for July claims business activity and incoming new work both expanded at slower levels than recorded in previous months. July’s headline figure of 57.1 – down from the four-month high of 58.1 in June – was lower than the average recorded since May 2013 (59.4), which Markit and CIPS says highlights a general growth slowdown from the peaks seen in 2014.

Despite remaining the fastest growing broad area of construction, house-building saw the greatest loss of momentum, with the latest upturn in activity the second-slowest since June 2013.

Tim Moore, senior economist at Markit and author of the Markit / CIPS Construction PMI, said: “July’s growth slowdown is the first for three months and perhaps a sign that the post-election impact on construction confidence has started to diminish.

“Residential activity expanded at one of the slowest rates for over two years, highlighting that the house-building sector is struggling to gain momentum despite supportive demand conditions.”

While civil engineering also expanded at a lower pace, work on commercial projects bucked the trend and saw activity rise at the fastest rate since March 2015.

With both output and new orders slowing throughout the month, July’s survey data also pointed to a slowing in employment growth across the construction sector. However, the rate of job creation remained much stronger than the long-run survey average and there were widespread reports of skill shortages across the sector. As a result, sub-contractor availability dropped for the 25th consecutive month, which is the longest continuous period recorded by the survey for over a decade, while charges rose at one of the fastest rates since 1997.

According to David Noble, group chief executive officer at CIPS, issues around sourcing skilled individuals have ‘remained a thorn in the side of the sector’ throughout July.

Meanwhile, there were signs that some supply chain pressures have started to subside, as construction companies were the least downbeat about vendor performance since May 2012.

Looking ahead, UK construction companies are highly upbeat about their growth prospects over the next 12 months, with more than half (55%) expecting an increase in business activity and only 4% forecasting a reduction.