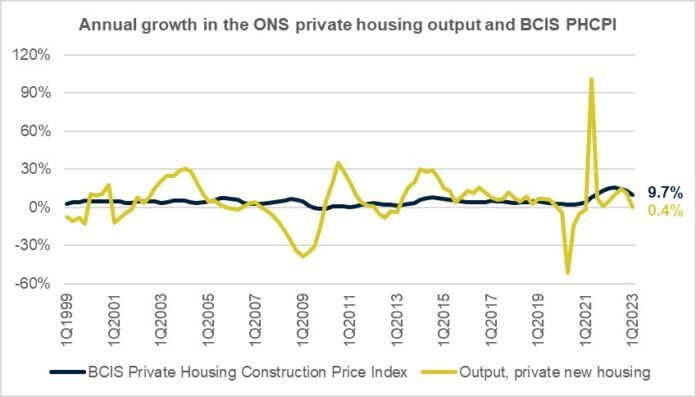

Annual housebuilding cost inflation as measured by the BCIS Private Housing Construction Price Index (PHCPI) stood at 9.7% in Q1 2023, down from 12.8% in Q4 2022 as costs increase by 1.4%.

This trend is in line with BCIS General Building Cost Index and All-In Tender Price Index, where annual growth for both has been easing since the peak in Q2 2022 – standing at 8.1% and 8.6% in Q1 2023, respectively.

Increases in the interest rate over the past 18 months by the Bank of England have significantly affected the housing sector, with new construction output in the private housing sector declining since Q3 2022, recording two-quarters of a contracting output (quarterly drops of 5.3% and 2.1% in Q1 2023 and Q4 2022 respectively).

However on an annual basis, the private new housing output has slightly increased, as presented in the chart pictured.

Housebuilding costs

Half of the respondents to the PHCPI survey attributed the increases in housebuilding costs to a rise in the materials’ costs. Meanwhile, 36% noted an increase in subcontractors’ costs, with only 5% reporting an increase in both materials and labour costs.

For the second consecutive quarter, PHCPI received some reports of a decrease in the materials’ costs (9% of responses).

Housebuilders expect the building cost inflation to continue to ease, reporting an expected 1% increase for Q2 2023.

April’s figures for headline (CPI) inflation and especially a high rise in core inflation indicate inflation is likely to be ‘sticky’ and to persist longer than previously thought.

This is likely to result in further interest rate hikes in 2023, from 4.5% to a possible 5.5% towards the end of this year (Interest rates have risen to 5% as of 22 June, the report was compiled before this).

Interest rate increases and consequent increases in mortgage costs will continue to adversely impact housing affordability and put more pressure on housebuilders.

Slowing demand

Demand is slowing, as reflected in April’s data for residential transactions, which reported a 32% drop in comparison with the same period last year.

Nationwide reports a negative annual growth in house prices since February 2023, standing at -3.1% and -2.7% in March and April 2023, respectively.

According to the latest data from the Department of Levelling Up, Housing and Communities, the number of private enterprise dwelling starts has dropped by 9.5% in Q4 2022, in comparison to Q4 2021.

UK brick deliveries that can serve a proxy measure for house building starts show a 10.5% and 31.8% drop in Q4 2022 and Q1 2022 when compared to the same periods of the previous years, further indicating a slowdown in housebuilding.

The introduction of the second staircase rule for new residential buildings over 30m has further contributed to a slowdown in the residential market; it is expected to have a particularly significant impact in larger cities, such as London, Manchester, and Birmingham.

With further monetary tightening expected this year and a sharp drop in housing starts, BCIS forecasts 2023 and 2024 to be particularly challenging for the private housing sector. BCIS expects the new private housing output to contract by 16.2% and 6.0% respectively, before returning to growth in 2025.