The latest statement from the Construction Leadership Council’s Material Supply Chain Group has reported good levels of product availability overall.

Previously reported issues regarding aerated blocks continue to be managed by allocated supply and certain roof tile profiles are on extended delivery.

The group also reported that the construction sector has followed the same pattern as the general economy throughout 2024; however, some current forecasts project it to finish the year in fact smaller than both 2023 and 2022.

The slowdown in demand over the past two years has led to a reduction in supply and stock levels. While this has been more than adequate for current conditions, a rapid surge in demand in the coming year may result in supply issues.

The second half of 2024 has seen more investment, giving a stronger pipeline of new orders. The sub-sectors with the strongest growth in orders are infrastructure, commercial construction and public sector and non-housing expenditure. However, new housing and domestic RMI remain flat.

Concerns for 2025

The Group said it recognises that a strong housing sector would deliver the widest economic and growth benefits across the UK, and it awaits government plans to stimulate this market. Ideally this would result in a gradual upturn through the first half of 2025 which will enable the material supply chain time to increase production and build stocks to meet the growth in demand in an orderly fashion.

It is worth noting that current brick capacity in the UK is around 2 billion. The last time the country built 300,000 homes a year, in the 1970s, brick capacity was 4 billion.

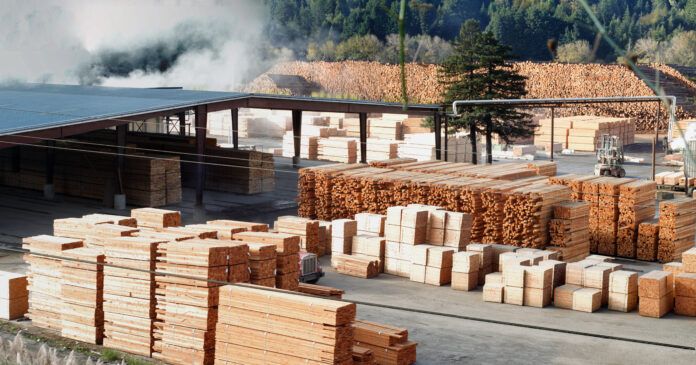

Additionally, much of the structural timber used in the UK is imported from Europe. While the UK has stock on the ground at the moment, log prices have increased in Sweden and suppliers are able to manage supplies to achieve the price they want. If the UK wants to expand the use of timber construction, the country will have to compete for its supply within a global market.

The market has been advised of price increases for several products in January ranging from 3% to 8%, largely stemming from higher energy costs. Some believe further price increases may follow in April stemming from higher employment costs.

Investment and costs struggles

The Group will undertake horizon scanning to include the impact of increases to National Insurance National Minimum Wage, Business Property Relief and inheritance tax. These issues are particularly relevant given how most businesses across UK construction – including builders, contractors, merchants and manufacturers – are SMEs and in many cases family-owned firms that will find it difficult to absorb extra costs and still invest in skills and capacity.

Such firms will be particularly reliant on a consistent pipeline of activity reflected from Government’s 10-year infrastructure and new housing strategies, which the industry will have to wait until Spring 2025 at least to learn about.

The Group is also sharing information on initiatives to address skills shortages across the supply chain from materials suppliers to those working on site.

Preparing for next year

While the Group is more optimistic for market growth in 2025, current forecasts expect any notable growth prospects, particularly for housing activity, to occur in the second half of 2025.

Members of the group strongly advocate that industry uses this time to plan, work closely with supply chains, and forecast and communicate requirements early with suppliers, distributors and builders’ merchants.