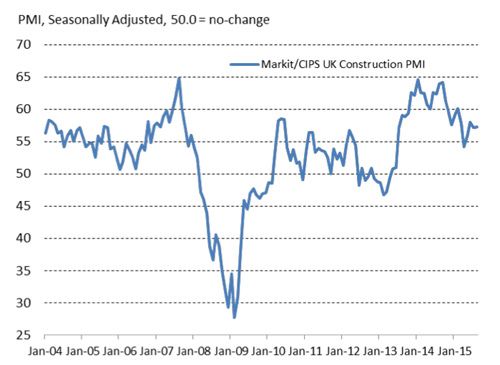

The construction industry is enjoying its longest period of sustained growth for more than seven years according to the latest report from Markit and the Chartered Institute of Purchasing & Supply (CIPS).

The Markit/CIPS UK Construction Purchasing Mangers’ Index (PMI) for August registered 57.3, which is only a modest increase from 57.1 recorded in July. However, higher levels of business activity have now been recorded in each month since May 2013, with house-building continuing to drive output within the industry. Growth of commercial work also accelerated, reaching its strongest since March, however civil engineering slowed to its weakest rise in output for three months.

Strong performance across the majority of the industry also led to a healthy rate of job creation in August. According to the survey, the current period of staff hiring now stretches to 27 successive months, which is the longest recorded by the Markit/CIPS PMI for just over nine years.

Tim Moore, senior economist at Markit and author of the Markit/CIPS Construction PMI, said: “The construction sector maintained its position as a strong engine of job creation in August, as permanent staff numbers and sub-contractor demand both picked up over the month.”

However, increasing workloads have once again pointed to the industry’s skills crisis, with survey respondents reporting ongoing staff recruitment difficulties this summer.

Mr. Moore continued: “The surge in construction workloads over the past two-and-a-half years has created substantial skill shortages across the sector.”

David Noble, group chief executive officer at CIPS, added: “Obstacles hampering strong progress were around the lack of available skilled staff as sub-contractors were still highly sought-after and offered higher wages. But, the rise in the level of permanent posts and employment generally rising for the last 32 months, confirmed an optimism displayed by more than half of the survey respondents.”

Despite the rate of growth within UK construction easing to its least marked since May, survey respondents remained upbeat about underlying market conditions and the opportunities to tender. This optimism also extends the year ahead, with more than half (53%) anticipating a rise in business activity over the next 12 months compared to just 5% who expect a reduction.

It was also found that lower oil-related prices have contributed to the weakest overall rate of cost inflation for four months in August.